how to claim california renter's credit

Go to the Input Return tab. If you pay rent for your housing.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

15 2022 and you can file online.

. California Gives Renters a Tax Credit. Your California income was. To claim the renters credit for California all of the following criteria must be met.

You were a California resident for the entire year. Gavin Newsom on June 28 2021 signed legislation that expands and extends the CA COVID-19 Rent Relief program designed to provide financial relief to renters and landlords with unpaid rental debt because of the pandemic. 87066 or less if you are marriedRDP filing jointly head of household or qualified widow er.

You may be eligible for one or more tax credits. That is California is one of a handful of states that does permit renters to make a claim to reduce taxable income through a renters tax credit. Lacerte will determine the amount of credit based on the tax return information.

Renter Landlord COVID-19 Relief Program Extended. You paid rent in California for at least 12 the year. Tax credits help reduce the amount of tax you may owe.

You were a resident of California for at least 6 full months during 2021. The property was not tax exempt. How to claim california renters credit Wednesday June 1 2022 Edit.

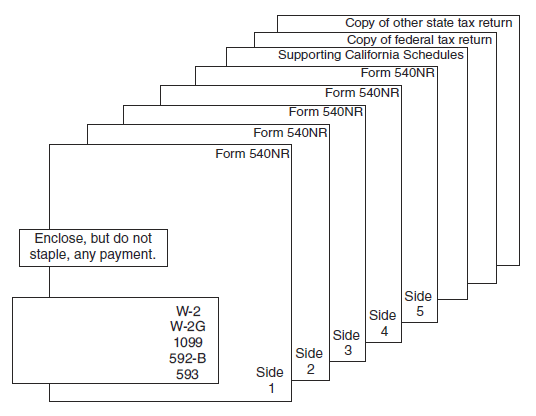

43533 or less if your filing status is single or marriedregistered domestic partner RDP filing separately. Depending upon the CA main form used the output will appear on Line 46 of the Form 540 or Line 19 of Form 540 2EZ. To claim the CA renters credit.

For the requirements you need to meet please see Nonrefundable Renters Credit. Check the box Qualified renter. There is good news for renters living and paying taxes in California.

85864 or less if you are marriedRDP. The New Jersey tax benefit is interesting because it gives renters a choice as to whether they would prefer a deduction of 18 of rent paid up to 15000 or a credit of 50 on. Subsidized Apartments - HUD helps apartment owners offer reduced rents to low-income tenants.

Go to Screen 53 Other Credits and select California Other Credits. California also has an earned income tax credit. The property was not tax exempt.

Have a family with children or help provide money for low-income college students. In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a tax credit of 60 or 120 respectively. From the left of the screen select State Local and choose Other Credits.

While the amount of the credit is modest at 60 for an individual or 120 for a taxpayer with the head of household status or a. Nonresidents cannot claim. Renters Tax Credit Applications for 2022 will be available for Maryland tenants on Feb.

The majority 87 of persons claiming the credit reported an adjusted gross income of less than 49999. The Nonrefundable Renters Credit program is a non-refundable tax credit. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident.

You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria. Select CA Other Credits. Your California income was.

In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively. The Nonrefundable Renters Credit is a personal income tax credit that is nonrefundable and can only be used to offset your tax liability meaning that if you dont owe any taxes this credit will NOT give you a refund. Kristina Brewer Dec 24 2019.

Complete the worksheet in the California instructions to figure the credit. To claim the renters credit for California all of the following criteria must be met. California allows a nonrefundable renters credit for certain individuals.

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. To request additional support with your application or appeal call the CA COVID-19 Rent Relief call Center at 833-430-2122. The program will determine the amount of credit based on the tax return information.

To see if youre eligible first find your gross household income on the chart in Column A. Hawaii renters who make less than 30000 per year and pay at least 1000 in rent for their. Renters Credit Nonrefundable.

To apply contact or visit the management office of each apartment building that. For additional information or for eligibility and application help you may wish to call the CA COVID-19 Rent Relief Call Center at 833 430-2122 or visit online here. Mark the checkbox labeled Qualified renter.

Check the status of your submitted application HERE. Assuming that you meet all of the requirements space rental for a mobile home would qualify you for the credit. To claim the CA renters credit.

California allows a nonrefundable renters credit for certain individuals. June 1 2019 246 PM. To be eligible an individual must be a resident of California.

If it exceeds the number in Column B you qualify for a tax credit of as much as 1000. The rent relief program re-authorized in AB 832 pays 100 percent of unpaid rent. The maximum credit is limited to 2500 per minor child.

The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident. Beginning July 1 though a landlord can evict a tenant. If you qualify for the credit well calculate the amount of credit youre allowed.

To qualify for the Californias Renters Credit you must meet the following. Locate the Renters Credit section. Your California adjusted gross income AGI is 45448 or less if your filing status is Single or Married Filing Separately or 90896 or less if you are Married Filing Jointly Head of Household or Qualified Widower.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com. You paid rent in California for at least 12 the year. 1 Best answer.

It can only lower the amount you owe to 0. 42932 or less if your filing status is single or marriedregistered domestic partner RDP filing separately. Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes.

A landlord cannot evict a tenant for non-payment of rent for the months in which rental assistance was provided. Who can claim the renters tax credit. If you paid rent for six months or more on your main home located in California you.

Fillable Form 1040 2018 Tax Forms Irs Tax Forms Income Tax Return

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Virtual Assistant Contract Freelance Contract Virtual Assistant Form Freelance Contract Form Graphic Designer Client Contract

Irs Form 540 California Resident Income Tax Return

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Sample 50 Effective Security Deposit Return Letters Ms Word ᐅ Rental Deposit Refund Let Business Plan Template Word Mobile Credit Card Certificate Of Deposit

Figure Home Equity Line Of Credit Heloc Review Heloc Line Of Credit Lending Company

Free 13 Sample Rental Application Forms In Pdf Excel Ms Word

Arizona Rental Application Form Download Free Printable Rental Legal Form Template Or Waiver In Different Editab Rental Application Arizona Rental Space Names

Free 9 Sample Rental Application Forms In Pdf Ms Word Excel

Printable Inspirational California Form Complaint Breach Of Contract Demand Letter For Constr Lettering Inspirational Printables Professional Reference Letter

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

11 States That Give Renters A Tax Credit

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com